Blockchain Integration in Finance 2026: Trends, Regulation & ROI

Introduction

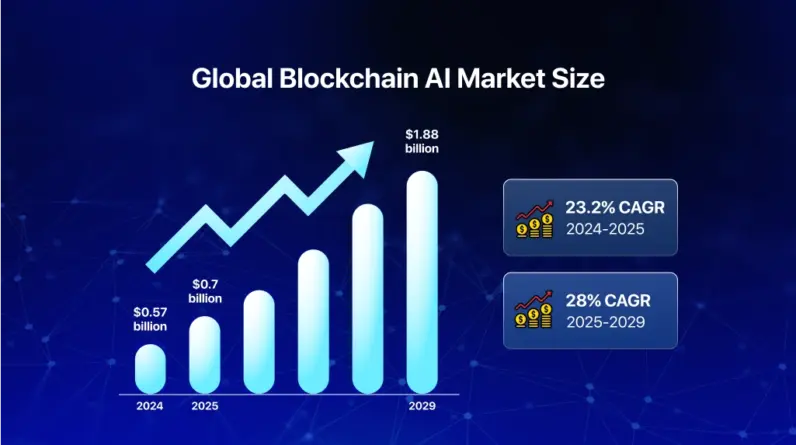

By 2026, blockchain is no longer a futuristic buzzword—it has become the backbone of financial innovation. Banks, fintech startups, and investment firms are racing to integrate blockchain into their systems. The reason is clear: better transparency, faster transactions, and stronger security. But with these advantages come new regulations and the constant need to measure return on investment (ROI).

1. Blockchain as the New Standard for Financial Transactions

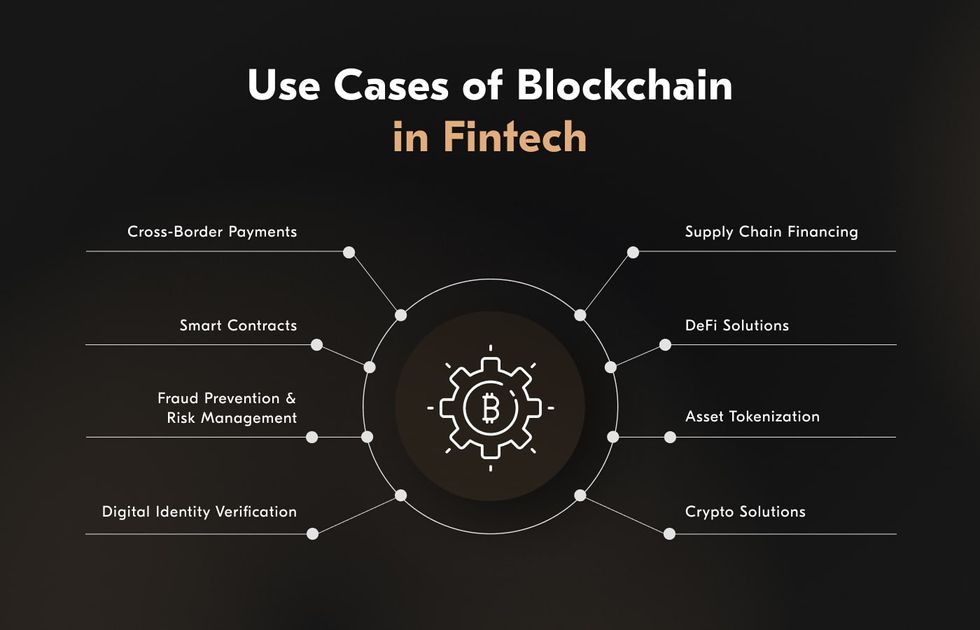

The financial world has shifted from experimenting with blockchain to making it the foundation of transaction systems. Cross-border payments are now completed in seconds rather than days, reducing costs and eliminating outdated intermediaries. Enterprises that integrate blockchain are reporting higher efficiency and customer trust.

2. Trends Driving Adoption in 2026

Financial institutions are embracing tokenized assets, decentralized lending, and blockchain-powered identity verification. Tokenization allows traditional assets like stocks or real estate to be traded instantly, opening new opportunities for investors. At the same time, decentralized finance (DeFi) platforms are being integrated into mainstream banking services, bridging the gap between traditional finance and the blockchain economy.

3. Regulation Becomes Central

With blockchain deeply embedded in finance, regulators are more involved than ever. In 2026, compliance frameworks are evolving to include anti-money laundering (AML), know-your-customer (KYC), and tax reporting requirements. Financial institutions that adapt quickly to these global regulations can operate seamlessly, while those that resist face costly penalties.

4. The Challenge of Interoperability

One of the major obstacles in 2026 is interoperability—ensuring that different blockchain systems can work together. Banks and fintech firms are investing in cross-chain solutions that enable seamless transfers of digital assets across platforms. This not only strengthens efficiency but also expands the potential of blockchain-based finance.

5. Measuring ROI in Blockchain Projects

For enterprises, the big question is no longer “should we use blockchain?” but “is it worth it?” ROI in blockchain integration is being measured in terms of faster settlement times, reduced fraud, and lower operational costs. Some firms are also reporting growth in customer acquisition, as clients are drawn to institutions that provide cutting-edge, secure, and transparent services.

6. The Rise of Enterprise-Grade Blockchain Solutions

In 2026, blockchain solutions tailored for finance are more advanced than ever. These enterprise-grade platforms provide not only security and scalability but also compliance tools built directly into their systems. This integration ensures that financial firms can adopt blockchain without disrupting their regulatory obligations.

7. Preparing for the Future of Finance

The integration of blockchain into finance is just the beginning. As quantum computing, AI, and decentralized identity systems advance, the financial industry must remain agile. Companies that treat blockchain as part of a long-term innovation strategy will be the ones shaping the future of money.

Conclusion

Blockchain in finance is no longer an experiment—it’s an expectation. In 2026, institutions that successfully integrate blockchain while staying compliant with regulations and demonstrating clear ROI will lead the industry. The winners will be those who see blockchain not just as a tool, but as the foundation of a new financial era.